As jewelry industry trends continue to evolve, branded jewelry is expected to be a major growth engine in the coming years. Effective branding builds strong consumer relevance and connectivity, which younger consumers appreciate, according to the latest insights from the 2023 Platinum Jewellery Business Review, organized in London by Platinum Guild International (PGI), the global marketing organization dedicated to creating and strengthening the market for platinum jewelry.

“The value of branding is well understood and developed in other luxury categories such as fashion but lags behind in jewelry. PGI leverages consumer research and insight to develop a brand application framework to unlock these opportunities. We have been working with our partners to ensure branded platinum collections with strong storytelling, designs, and new technologies meet the aspirations of our consumers,” said Huw Daniel, CEO of PGI.

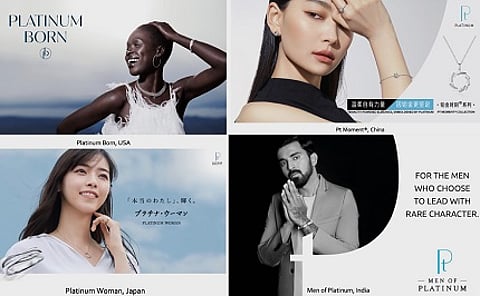

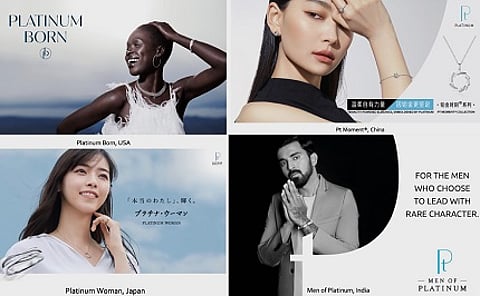

United States: Offering platinum metal-only, fashion-focused branded collection for American women

After reaching a record level of sales in 2021, the US platinum jewelry industry saw another year of noteworthy performance. Retail sales increased a further 9% year-on-year, despite facing multiple challenges in 2022, including inflation, global supply chain issues, the war in Ukraine, and resulting sanctions. The outlook remains positive for 2023 as consumer spending remains robust and high gold prices make platinum a favorite for the price-sensitive trade.

Previously, only a limited range of platinum jewelry was available outside the bridal market in the US. Platinum Born, the metal-only platinum brand, brings a fashion-forward jewelry collection that helps empower a sense of modern femininity, especially among younger women seeking unique designs to express their individuality.

Platinum Born has expanded platinum into distribution channels that have had limited platinum offerings historically, including high-end department stores like Neiman Marcus and Saks Fifth Avenue. The brand added 23 new SKUs in 2022, both at higher and lower price points. In 2022, unit sales doubled, and dollar sales increased 60% over 2021.

Japan: Delicate, affordable pieces reflecting the values of young Japanese women create an intro-priced platinum category and seed future demand

Platinum is the go-to jewelry metal for good quality jewelry in Japan, representing a quarter of all jewelry unit sales in 2022. With many pieces of high-end jewelry only offered in platinum, its average unit price is considerably higher than the market average. Platinum’s elevated status is a strong foundation for branded jewelry.

Reflecting the sharp uptake in consumer interest in jewelry led by COVID-19, the Japanese jewelry market in 2022 recorded the highest sales in 14 years. Platinum jewelry retail ounce sales grew by 6.2% year-on-year and are expected to remain positive, thanks to a recovery in consumer sentiment and the return of tourists shopping for jewelry.

While Japan is an ageing society, it also has a substantial cohort of young consumers, primed to embrace platinum. Women between the ages of 20 and 34 are increasing their income and willingness to spend on themselves. They want jewelry that speaks to and about who they are, but are often overlooked by the jewelry industry, outside of bridal.

Platinum Woman is the platinum brand that addresses the needs of the next generation of heavy platinum jewelry buyers through its affordable and youthful collection from four top-of-class retail partners. Thriving since its launch in November 2020, partner sales continued to grow in 2022, with a 69% increase in value over 2021.

China: Fashion-forward platinum brand speaks to young Chinese women, delivering results amidst uncertainties

China ranks first among all jewelry markets in the world, but growth has shifted from Tier 1 and 2 cities to lower-tier cities. During this transition, China is moving towards large jewelry retail chains that are quick to use more branded jewelry.

2022 was an extremely challenging year for the Chinese economy and consumers, with approximately two fiscal quarters of stifled business activity. Consumer confidence continued to weaken on the back of multiple sporadic COVID outbreaks. Traffic to both manufacturing showrooms and retail stores was significantly affected.

Platinum jewelry fabrication slumped by 32% year-on-year to less than half a million ounces in 2022. With store traffic being severely affected, retailers were reluctant to replenish products and instead sought to keep stock levels to a minimum.

Uncertainty remains in 2023 despite some recent recovery, but in the long term, the introduction of premium platinum products will create appeal to both consumers and the jewelry trade. Branded collections such as Pt Moment have been contributing to the post-COVID recovery in China and will continue in the future. Aiming at young women who want to embrace tenacity and elegance with their own take on contemporary femininity, this branded collection offers affordable non-bridal precious jewelry options that fit their needs.

Powered by design innovations and new technologies, the branded collection featured more than 150 SKUs in 2022, and increased distribution from around 50 doors in 2018 to 1,800 in 2022. The sales volume of Pt Moment grew at a CAGR of 11% during 2020-2022, despite the COVID outbreaks and pandemic-control measures.

India: Celebrating strong values and tapping into the cohort of young, affluent, urban men in the fastest-growing platinum market

India has a mature jewelry market and a deeply entrenched jewelry culture, with a large base of young and financially independent consumers. As chain retailers and the organized trade are set to lead the jewelry industry’s growth, platinum creates significant value by addressing the needs of the young consumer and driving bottom line growth for the partners.

Designed to drive conversion and margins, platinum was the top-performing jewelry category in 2022, delivering 20% year-on-year growth in fabrication to a total of 198K ounces. At the retail level, PGI partners reported an increase of 26% in 2022 compared to the previous year. PGI expects the strong growth in platinum jewelry to continue in 2023, helped by platinum’s unique margin opportunity and strengthening consumer demand.

India’s 12.2 million young, affluent, urban men are a ready market for branded jewelry which currently represents a white space. Men of Platinum in India was created by PGI to meet the aspirations of these men, recognizing their evolving values and aspirations, which no jewelry currently captures.

In 2022, Men of Platinum leveraged India’s love for cricket through its brand ambassador KL Rahul, a cricketer who embodies the values of the brand. Together with partners’ co-promotions, retail sales have increased fivefold since its inception, and distribution has doubled to almost a thousand doors.

“While our approach differs from country to country in order to meet the needs of local consumers, it’s clear that branded collections are a major growth engine for the future of the platinum jewelry industry,” Mr. Daniel said.

Follow DiamondWorld on Instagram: @diamondworldnet

Follow DiamondWorld on Twitter: @diamondworldnet

Follow DiamondWorld on Facebook: @diamondworldnet