A crisis brings out the worst and often the best within us. The diamond industry, bogged down by the economic slowdown, is enduring the pressures of a severe cash crunch, stark competition, decline in demand, downfall in growth, and drop in revenues. Frauds are rampant and relationships between players, strained. Sympathy is easier to give than credit.

The industry is beat, its ethics or lack are being questioned, but love for the diamond that drives the industry has compelled players to quickly realign to this new normal and figure out that co-operation may well be the easier way out of the crisis.

Tough Times

“The last two years have been particularly tough, says Harsh Maheshwari, Director, Kunming Trading Company, Hong Kong.

The Chinese demand had compelled companies to participate in trade shows. Today companies participate but the demand is down.

“Each show involves time, effort and investment. The return on investment has fallen dramatically over the last two years. Stock values are down, expenses are high. Naturally, we are cautious with clients and suppliers and hesitate to give goods on credit. Those who are sincere, understand the liquidity crunch and put the cash on the table,” Maheshwari explains.

But many, not able to take on the credit uncertainty, have either shut shop or face bankruptcies and the prospect of closure. There is no clear vision of how long this situation will continue.

“Initially, we thought it’s just a phase. But it will take a while to dissipate. The Chinese demand will take time to revive. No one is making fresh investments,” Maheshwari warns.

This situation may well change the very thinking pattern and thought strategy of the industry.

The New Normal

“A cultural shift is necessary to meet the challenges,” Maheshwari comments.

Processes need to change. For example, in USA and Europe, providing business references is part of the professional culture. In Asia, this is viewed with suspicion. This needs to change.

“In India, we trust the familiar and prefer to do business with people who have been around, which has often backfired. There is even a risk when the clients are well-reputed. But people learn. The old ways are changing. This is the new normal,” Maheshwari explains, probably echoing the sentiments of Bruce Cleaver, the new chief executive officer of De Beers, since July 1, 2016.

Cleaver, in his first public statement, observed that “Volatility in the global political and economic environment is “the new normal.

Paying Partnerships

It is a time for cleansing. Industry leaders have been brainstorming, to face the new challenges, be it developing supply chain efficiencies, a credit rating system for industry players, forging new partnerships or preparing new marketing strategies in collaboration with other players. The crisis is making industry players close ranks and come together.

As Bruce Cleaver stated, “The industry’s ability to collaborate is one of the reasons it has been so resilient. It is partnerships, the cornerstone of the business, that will define our future.”

Agrees Caylee M. Kozak, fine jewellery worker and industry writer. “The industry is certainly in pain, but I would like to believe it's the pain of evolution, rather than implosion. The industry needs to unify, and foster a greater commitment to work together and share skills, strategies and markets, which cannot happen until we stop trying to tear down the competition and learn to work together. It is only through major cooperation and a re-energisation of modern sales and marketing will we see some forward, upward momentum. Only then, can we convince the consumer to trust in the intrinsic value of purchasing jewellery.

Investing In Industry

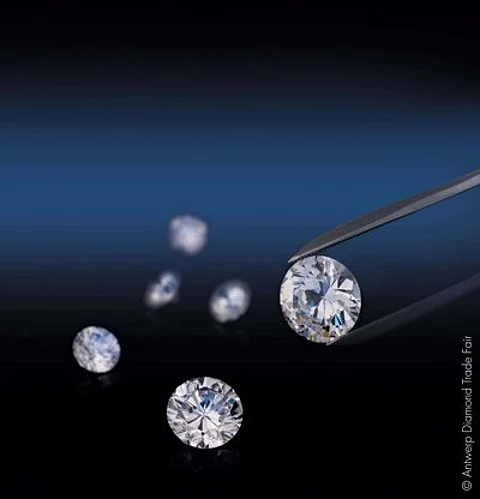

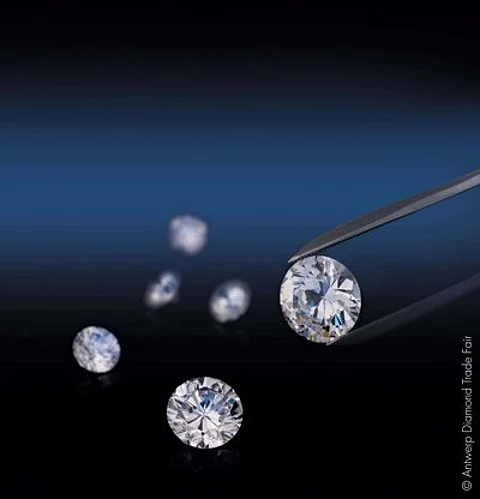

Long ago, to create demand, De Beers initiated the historically popular ‘A Diamond Is Forever’ marketing campaign, to boost the industry. The campaign was like the rising tide that lifts all boats. It worked because everyone could borrow the phrase and incorporate it into their own messaging. It also struck an emotional chord associating the diamond with love and commitment. “Nobody pointed to De Beers as the sole owner of the catchphrase. It worked for the industry,” observes Kozak.

Around 2010, due to aggressive competition and an uneven playing field, Belgium felt the need to bring the industry together. The country has no diamond mines, yet almost every rough or polished diamond transits Antwerp before being reshipped to world markets. Antwerp wanted to complete a comprehensive restructuring of its Antwerp World Diamond Centre (AWDC) operations and responsibilities to position itself as the most efficient and friction free diamond trading market in the world. The Antwerp Diamond Masterplan intended to consolidate the sector by creating jobs, increasing diamond trade and enabling growth.

The momentum helped in discussion of key fundamental issues relating to tax, legal, security, community integration, public image, competitiveness, innovation, technology and modernisation of the diamond industry.

Today, the project has mutated into Antwerp's new campaign, 'Diamonds and Antwerp, It's in our DNA.'

"The philosophy of Project 2020 is still very much alive," asserts AWDC. There have been fresh initiatives in Antwerp, considered the mircrocosm of the diamond industry, to create cooperation among various communities in Antwerp.

The AWDC recently launched Antwerp Diamond Experiences, as a part of the DNA campaign, that seeks to develop international trade relationships with new diamond markets,like Kuwait, Bahrain and Turkey.

Another initiative is AWDC cafes, which are events to initiate discussion on immediate industry concerns like automatic exchange of financial information or even e-commerce counselling on working a website into a profitable asset, besides seminars on compliance, KYC norms for the industry and security.

Credit Rating System

Ideas, like water, spread to find their level. Tapping into new markets like Macau or even evolving a credit rating system to access information and inspire confidence were floated.

“We need a rating system like Moody's that will help players in the business to gauge the relative worthiness of a potential client,” observed Maheshwari.

Under an open credit rating system, individual playerswould each get to rate a transaction. All transactions, who one buys from, sells to will be recorded and rated. Such information will be madeavailable to all players.

“A rating system will help to open up opportunities and bring in transactional transparency,” Maheshwari believes.

Actually, the concept, intended to protect players from fraud, is similar to membership in insular groups such as the New York Diamond Dealers Club that onceensured a network for free flow of market information to make credit choices and allowed members access to a private arbitration system, which was discrete, efficient and effective.

Today, such institutions have crumbled. “The Club suffered from financial mismanagement, a failure of leadership and accounting irregularities,” states Barak Richman, Professor of Law and Business Administration at Duke University in his working paper, ‘An Autopsy of Co-operation - Diamond Dealers and the Limits of Trust-based Exchange.

Take To Technology

In a market that istoo fragmented and individualistic, players have turned to technology that can work innovatively to ease costs.

Diamond manufacturers recently created a mobile application to enable pictures and videos of an individual polished stone to be viewed by aretailer, who can place the order. “This lowers investment costs and cuts risk in a buyers market. Such an app also allows players to respond to definitive demand, rather than investing in a wide variety of stones to suit demand. Technology may be used to create a more specialized market,” informs Maheshwari.

Formal Associations

On a more tangible level, major industry players initiated formal collaborations for cooperation. Says Sachin Jain, President, Forevermark, “Different parts of the pipeline can – and do – work together on areas of common interest, like the Kimberley Process Certification Scheme; or evenin marketing and advertising. We can look to work together by understanding what the opportunity or challenge is, how the industry should best respond and what role is most appropriate for each business as part of that response.”

Cooperation For Mutual Benefit

De Beers has been playing its leadership role, for mutual benefit. Especially, in key issues like credit, transparency, and marketing. Banks, once bitten, twice shy, are unwilling to risk investment in the diamond industry. To raise banks confidence, De Beers required its sight holders to align their financial reports to International Financial Reporting Standards. To access a regular supply of roughs, sight holders had to comply.

Or when De Beers gave up investing in a generic marketing program for diamonds, jewellery manufacturers and retailers took up the baton for doing their bit for diamond demand. But stray efforts to market individual jewellery brands have not worked. De Beers stepped in to drive diamonddemand, by compelling sight holders to make considerable investments in marketing as part of their participation in the company’s Supplier’s of Choice program.

“There have been moves towards cooperative marketing approaches in the industry to stimulate consumer demand for diamonds. There is already some tangible benefit from some of these efforts in the pipeline, which is a positive step for the industry,”Jain said.

Cooperation can help to pool resources for a greater net impact, besides allowing players to share best practices to respond to challenges and opportunities.

“It can also help the diamond industry compete more effectively with other sectors, such as luxury electronics or experiences,” adds Jain.

Investing In Relationships

Obviously, the industry’s success is built on relationships. But majorly, it is the bigger players that have taken the initiative to forge equations for mutual benefit.Perhaps it is time for smaller players to come together and sweep in the revolution to change the market.

For instance, sight holders recently compelled De Beers to accept the reality of hard times and defer the acceptance of roughs. Perhaps they can also compel De Beers to lower the prices of roughs and allow the industry some breathing space?

It is no doubt a tough time. But industry elders have faced crisis situations before and learnt to adapt, be it setting up office in a new country, changing the product mix from gemstones to diamonds or building co-operation. Only when there is the intention and willingness to transform, the industrycan ensure a business future for its diamond children.

Follow DiamondWorld on Instagram: @diamondworldnet

Follow DiamondWorld on Twitter: @diamondworldnet

Follow DiamondWorld on Facebook: @diamondworldnet